Property vs Stocks...

Pushing a rock down a hill….

The majority of people online, telling you stocks and shares are the best way to make

money, are wrong

And I’ll tell you why

First, some context, recently there has been a huge upswing in the amount of people

following the FIRE approach to retirement

That’s - Financial Independence, Retire Early

Basically this involves saving as much as you can, as hard as you can, into a diversified

portfolio of stocks and shares (usually ETFs) until you can retire

It also involves being miserable for 10+ years until you can retire early

And even then, you have to live modestly as you still ‘have’ to live another 40-60 years or

so on whatever you have saved

Sign me up, right? Nah. Cheers.

Context;

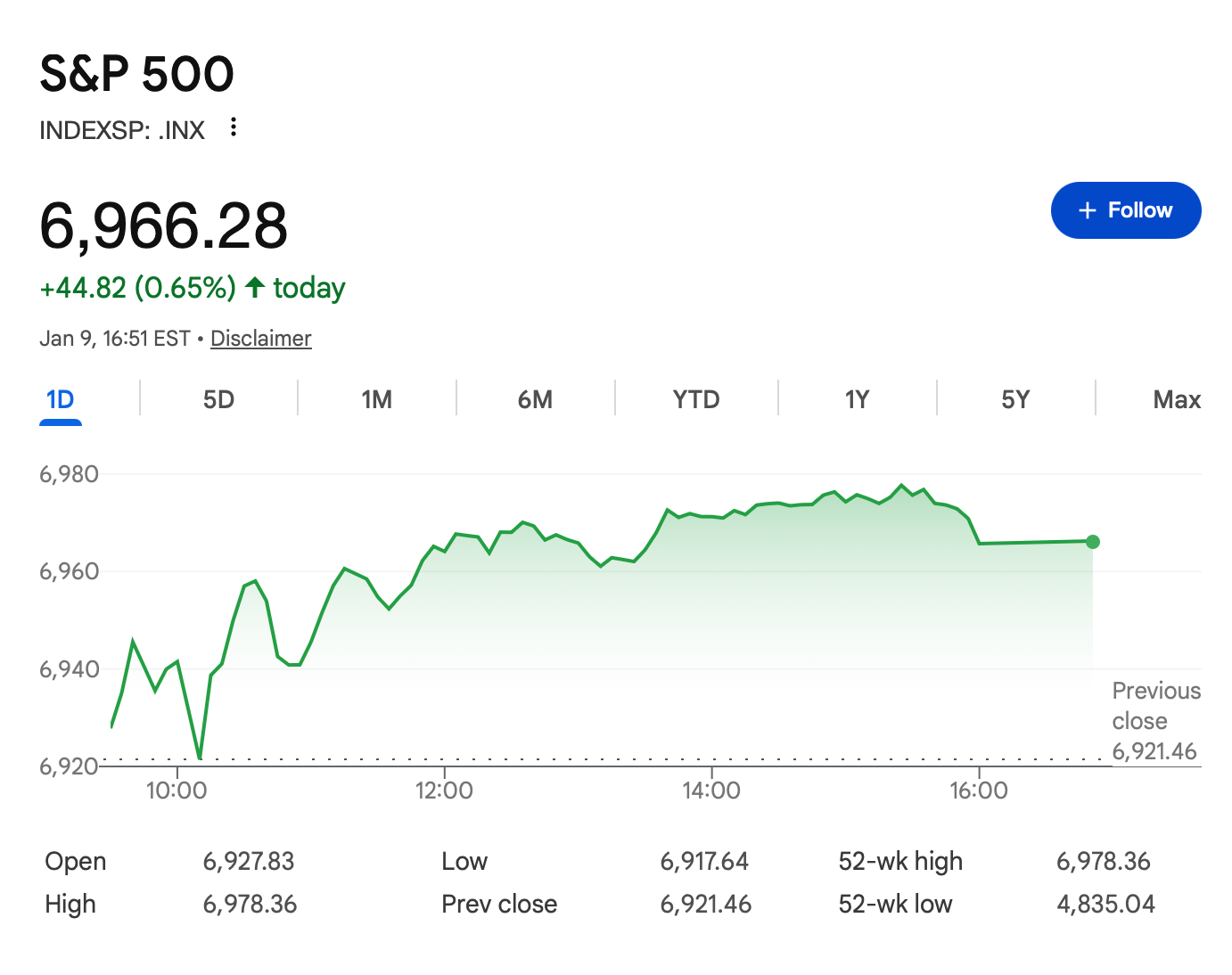

In the past 12 months, the S&P 500 (which tracks the largest 500 trading companies in the

US) grew 19.55%, which is great

But, the problem with a stock or share is that you only realise that gain, i.e. it becomes real,

when you sell the asset. Then you no longer have it. Future earnings gone.

In addition to this, can you guess what the single biggest 1 week drop was in the S&P 500

this year?

In a five day period in April 2025 it dropped 11.5%, and close to 20% from its high a month

earlier…

So for all you FIRE people, that’s 8-12 years of your savings… poof (yes it did come back)

With property, you get two types of return, one that’s active, and coming in monthly - the

income from the tenant when he pays you to live in the property

And then the growth in the property value (which is akin to share price increases)

But, with property you have a trick up your sleeve that can allow you to access this growth,

without selling the asset

Yes, whilst the headline rental income and growth figures may be lower on property (vs

stocks and shares), they become much higher when you use a property investor’s secret

weapon

A mortgage

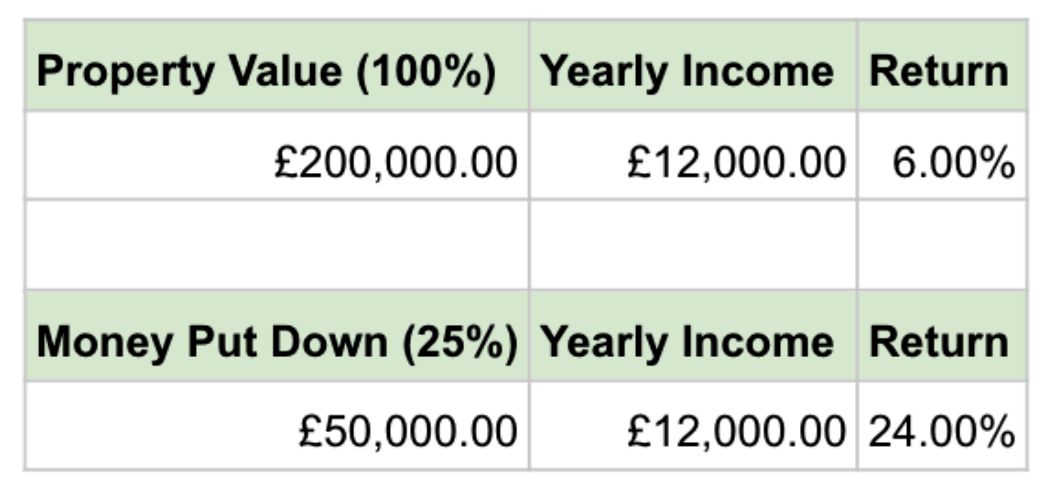

With property, you only need to put down a 25% deposit, and a mortgage covers the

remaining 75%.

For example, a GBP200k property needs GBP50k down.

This is also known as leverage… think about trying to push a large rock down a hill, you

can’t, but if you get a lever and a smaller rock, you can use the smaller rock as leverage to

move the much larger one….

A mortgage lets you ‘move’ into more return

Leverage, in turn, increases the return by fourfold.

The return from the rent is 6%, on a 200k property this is 1200 per month…

It now becomes 24%.

If the property values go up 7%, that becomes 28% per annum.

Both, beating stocks and shares.

Oh, and can anyone guess what the single biggest one week change in property prices

was?

I can’t find the data for a week, but the largest monthly drop was 1.8%

Solid, tangible, secure, stable, leverage.

Thanks,

Callum