“ Never too old / Never too young “

Have you ever heard or said either of these?

I am too old to try / start / change

O

I am too young to try / start / change

Most of us know that the latter is less of an issue

When young, you have:

Less to lose. More to gain

No commitments

Time to start again

But, a lack of experience and, some would say, a higher chance of failure (although I disagree)

When you are ‘old’ (what is old nowadays anyway?):

More to lose, more commitments, family, dependents, something that is already "working" but could be

better

Do you settle or no?

Some that chose not to:

Colonel Harland Sanders - started KFC at 65

Ray Krok - started (or you could argue stole) McDonalds at 51

Chaleo Yoovidhya - started RedBull at 61

Richard Branson - started Virgin at 20…. But still running it at 74

I guess the point here is that you are never too old to start

A new hobby, a new job, a new business, a new ‘side hustle’, trying new foods, new holiday destinations,

whatever it may be

And this seems to be a common theme whilst meeting people recently

The concept of a traditional retirement seems to be gone

Most people want to pivot, try a new career set their own thing up, give back, spend their time the way

they want, with who they want

The common theme though, is the need to create income, or ‘set yourself up’ so that you have the

choice and opportunity to ‘pivot

People are living longer…. You will live longer (I hope)

What does this mean?

When you combine it with the fact that we are ‘pivoting’ and not retiring, it means that your ‘investment

horizon’ is much longer

It’s not a case of “I want to retire at 40, 60, 60 or 70” so, therefore, you have until that age to work towards

If you are 40, your investment horizon is 50 years

If you are 50? It’s 40 years

60? Then 30 years

70? 20 years. Potentially more.

So, are you too old to start?

No.

For example:

At 40, if you start putting £500 into an ETF every month, you will have £328k at 60, and £2.3m at 80.

If you buy a £200k property with a £1k per month income at 50? A property valued at £530k come 70,

with income of £1.8k per month.

Most of the power of purchasing property (or any investment vehicle) comes in the long term

Time IN the market, not TIMING the market

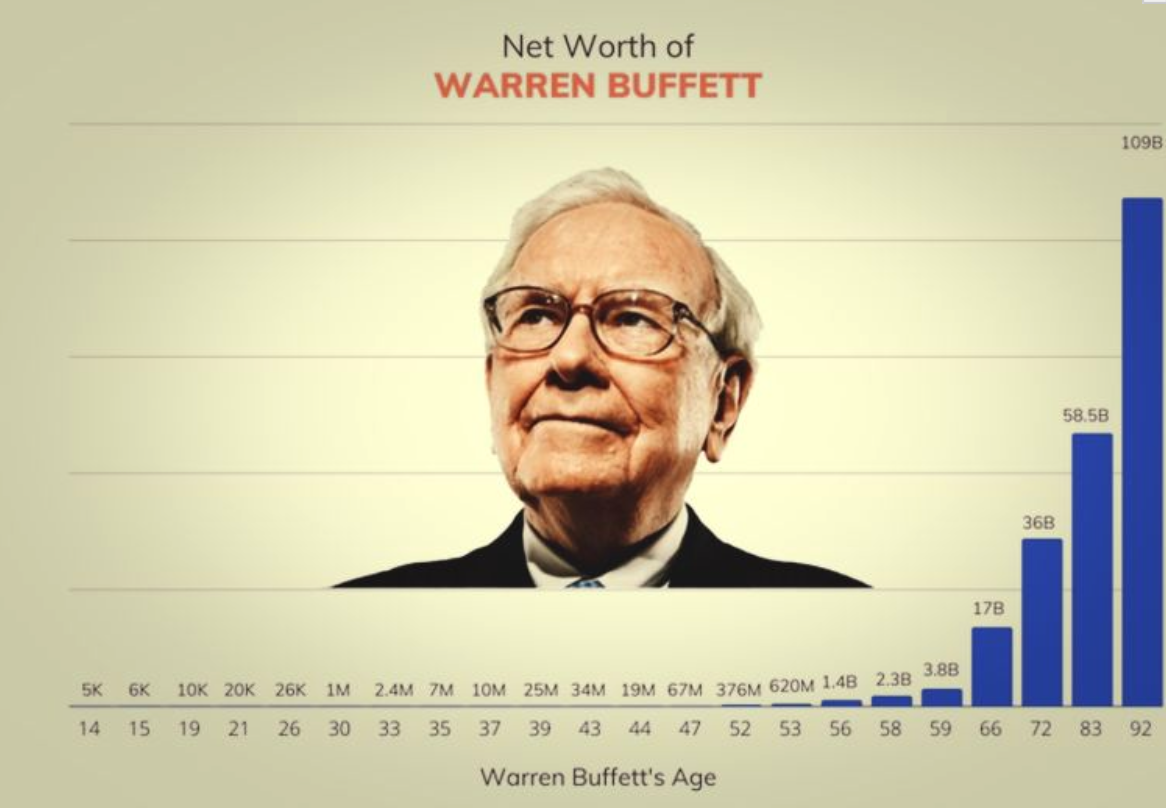

Not convinced? Have a look at Warren Buffets ‘time in’ the market below:

Now we do not have to replicate this man, but we can start

Do something small

That moves us in the right direction

Give your future self a green light.

Think a friend would like this? Forward it their way.

Have a great weekend ahead,

Callum