Red Pill / Breaking the Matrix

“I am breaking out of the matrix”

“Big things are happening, watch this space”

“We are building generational wealth”

These comments were made to me by an ‘acquaintance’ recently

Whilst admirable, I felt they lacked substance, and a clear plan for execution

More of a hope

Why do I feel the need to mention this? More and more recently I have been hearing the term;

Generational wealth

And how to build it

On the flip side, I recently met a client with a clear plan to do this

With a clear plan, and pure intentions, there is nothing more noble or admirable

Wanting to create a better quality of life for people you may have not met yet

Your future generations

Your lineage

Mine will not be so lucky…

I plan to spend it all before I kick the bucket

Make sure my children are set up, perhaps help them with a house purchase, good school - yes

But leave them a heap of money they won’t know what to do with?

Yes, they will know how to spend it

But not how to grow or manage it

(unless, of course, I teach them… more on that later)

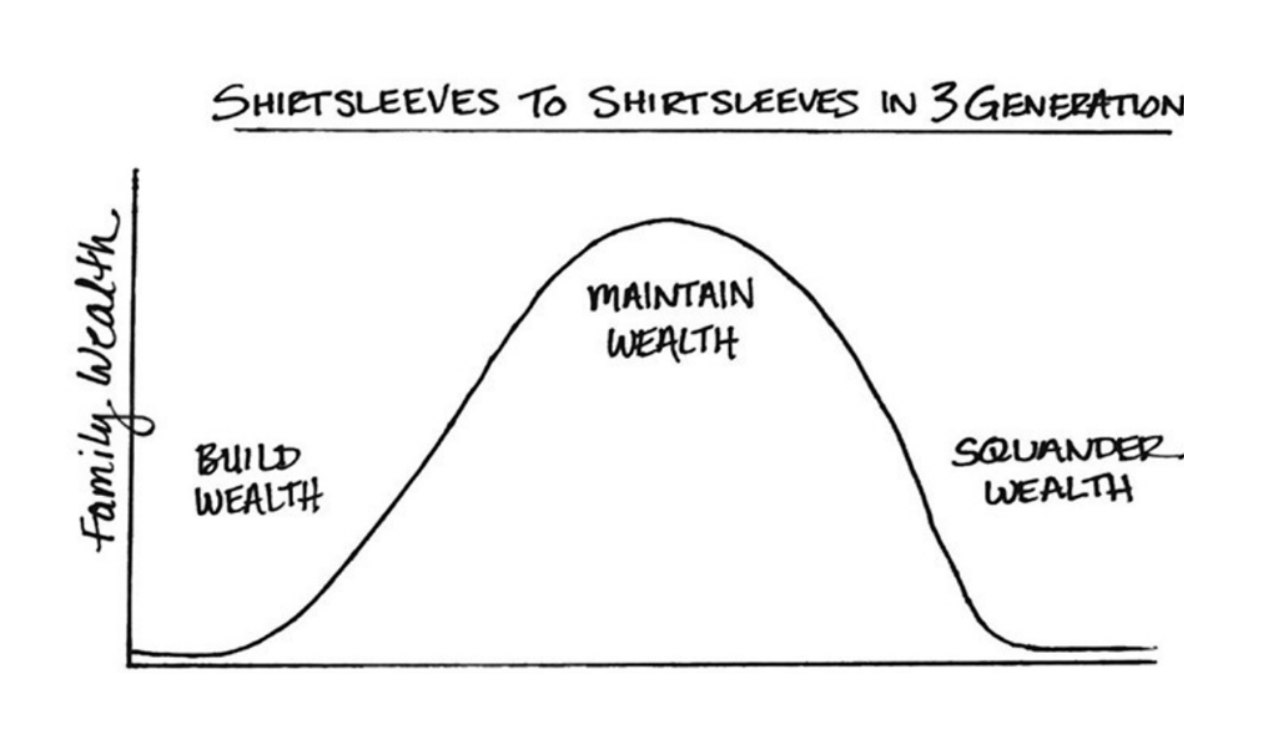

The Three Generation Curse of Wealth

Or

‘From shirtsleeves to shirtsleeves in three generations’

According to a 25 year study by The Williams Group, conducted over 20 years, and studying 3250 wealthy

families;

70% of a family's wealth is squandered by the 2nd generation

90% of the family's wealth is gone by the 3rd

Why?

The first generation: build it, come from nothing, entrepreneurial, savvy, hard-working

The second generation: they are more conscious of the work it took the family to build wealth, perhaps

they have memories from when they are children- they have seen their parents struggle

The third generation - they are born into wealth, they know nothing of the trials and tribulations to get

there. They are accustomed to money and to spending it. But not in the getting on preserving of it

Yes, there are other factors at play, more people to split the wealth between each generation, lack of

estate planning, taxes, etc

Examples?

You have probably seen it in day to day life - children of wealthy parents always wanting/getting the new

iPhone for Christmas

Younger generations with no jobs, using parents money (through choice, it is different if you are trying to

find a job)

Some historical examples;

The Vanderbilts

Cornelius Vanderbilt, forefather of the American railroad industry, by 1862 had a fortune of $663m (in

today's value) - inherited by his children and squandered, 50 years later, their home was sold and

demolished

The Hartfords

George Hartford build one of the first chains of grocery stores in the US. In 1965 it was the biggest retailer

in the US.

His son did not build the wealth, but was left $90m. It was lost on failed business ventures, 4 divorces,

and failed property development projects. He did not have the skills or knowledge.

How do you prevent this?

Proper planning and education

For yourself and your family

Reading ‘The Family Vault: How to Build Generational Wealth and Keep it’ recently, and the author focuses

on education, with lessons such as;

Live for today, plan for tomorrow

Do not allow personal expenses to exceed your lifestyle

See downturn as an opportunity

Invest objectively

Prioritise wealth over ‘riches’

And

Leave a lasting legacy

Anyway,

More of thought piece as opposed to specific property information this week

Of course, property is a tried and tested way to build long term lasting wealth - if structured correctly

Allowing you to grow your capital, and create income for yourself, before passing it onto future generations.

Think a friend would like this? Forward it their way.

Have a great weekend ahead,

Callum