The Prisoners Dilemma & The Budget

I am reading a book about ‘game theory’ at the moment.

Developed in the 1950’s by a gent called John (Johnny) Von Neumann, who was also one of

the key figures that worked with Oppenheimer on the nuclear bomb.

He developed game theory to try to understand how rational humans will make decisions.

Surely, he says, there is a logical, rational and correct way to play a game.

And, if this is the case, then the answer/outcome should always be the same.

One of the key ‘games’ in game theory is known as the prisoners dilemma;

This highlights the fact that humans do not always make rational or logical decisions.

Two members of a gang are arrested, held in solitary, and have no means of speaking with

each other.

The police admit they don't have enough evidence to charge both on the principal charges.

So they aim to charge both on lesser charges, with one year’s prison time.

Simultaneously they offer both prisoners a ‘Faustian bargain’;

If he testifies against his partner he goes free and his partner gets 3 years.

If they both testify, they both get 2 years.

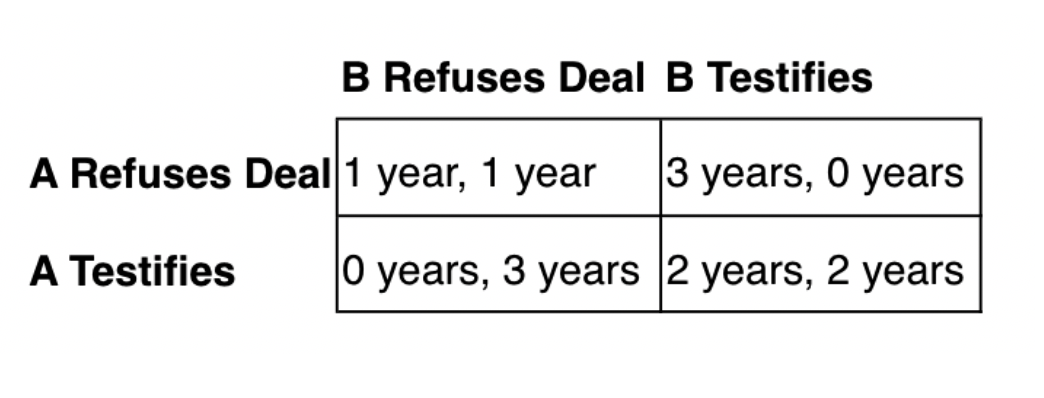

The outcomes look like the below;

What would you do?

The reasoning is that the rational thing to do is refuse the deal – 1 year each.

But in most cases, the prisoners realise that if they testify they could get 0 years, but the

most they get is 2 years, which is still lower than the 3 they were originally looking at.

Therefore, the logical option is to testify, as it takes a year off your sentence no matter what

the other prisoner does.

If you refuse, you may get 1, but you may also get 3.

He then goes on to talk about a heap of other ‘games’ where logic and rational are at

opposing ends; the free rider dilemma, the stag hunt dilemma, the game of chicken

dilemma (which was played on a deadly stage during the Cuba Missile Crisis).

How is this relevant to property?

It shows how as humans we often don’t make logical or rational decisions.

Which is a mistake when it comes to buying investment grade property.

Yes, if you are buying your forever home you should take logic out of it, the decision should

be purely emotional; can you see yourself living in the house, will you be happy there, etc.

If it’s an investment then this is irrelevant, it doesn't matter if it’s in an area you know, or if

your friends can check up on the property, or if you would be happy living there.

It’s all about the fundamentals; will tenants want to live there, are there enough quality

employers nearby to drive demand from good tenants, are there transport links to get

people to and from work/recreational activities.

Do the logical thing…. Testify! (i.e. buy property based on what the data tells you…)

Budget;

In my opinion, three key points for overseas property investors;

Personal tax thresholds frozen until 2031… will push more people into paying more

tax over time - if you own property in your own name.

2% additional tax on income from savings, investments and property from 2027… again, only if you own property in your own name.

Changes to national insurance… you now must have worked in the uk for 10 years to qualify….

All covered in our budget review podcast last week. See below.

Thanks,

Callum